The solar PV industry is starting to hit the mainstream in a big way, with countries increasingly favoring solar PV as the renewable energy of choice. With climate and pollution problems becoming rampant across the globe, many countries have started to view solar PV as a panacea to such problems. Unsurprisingly, many countries have started to accelerate their solar PV installation targets, chief among them being China and India. As both these countries make up for more than one-third of the entire global population, their increasing solar ambitions will have a disproportionately positive effect on the global solar industry.

With China and India's accelerating solar PV goals, it almost seems as if these countries are trying to outcompete each other in terms of their respective solar PV ambitions. For instance, China has been implementing unprecedented coal caps among many other things, while India has been rapidly increasing its solar investment targets. Of course, these countries are likely only trying to do what they perceive as best for their respective societies. With pollution and climate issues becoming worse than they have ever imagined, it is only natural that these countries have started to rely more heavily on solar PV. Solar PV is after all one of the few energy technologies with a declining cost curve. China and India's rising solar ambitions are great news for the global solar manufacturing industry, and will likely be key demand drivers moving forward.

DEMAND DRIVERS

Given China and India's own stated solar PV growth goals, these countries could very well be the main source of Solar PV demand over the next decade. On top of this, China and India's electricity consumption growth will almost certainly outpace the global electricity consumption growth rate. India's Modi-led government plans to install 100 GW of solar PV by 2022, and many prominent industry experts speculate that China will easily surpass its own 100 GW solar PV target by 2020. In other words, China and India will install approximately 200 GW of solar PV in about 5-7 years' time, which is a figure that seems almost unimaginable by today's standard.

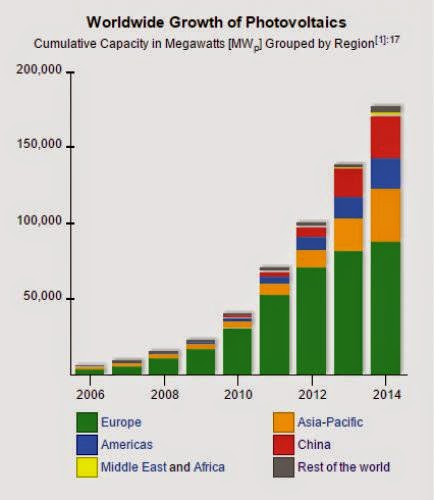

To put this number into perspective, China and India will install more solar in the next 5-7 years than the entire world had installed up until now. Given the fact that the solar industry has been around for more than three decades, this will be a huge accomplishment for China and India if they are able to follow through with their plans. This will be made all the more impressive given that both these countries had nearly nonexistent solar markets just a decade ago. In fact, India's current solar market still barely registers on the global stage. With these two countries driving solar growth, the industry will likely see unprecedented demand in the next decade.

"In just 5-7 years' time, China and India plan to install a solar PV capacity comparable to what the entire world has installed until up until now."

"Source: epia"

IMPLICATIONS ON THE GLOBAL SOLAR MANUFACTURING INDUSTRY

Clearly, China and India will have an enormous impact on the solar manufacturing industry moving forward, as these countries will stimulate module demand in a huge way. Global solar manufacturers such Trina Solar (NYSE:TSL), Yingli (NYSE:YGE), and Canadian Solar (NASDAQ:CSIQ), all stand to gain enormously from China and India's slated solar PV growth. While China's solar market is more heavily dominated by domestic Chinese solar manufacturers, India's solar market is wide open. In fact, some of the largest Indian solar market participants have been U.S.-based manufacturers such as SunEdison (NYSE:SUNE) and First Solar (NASDAQ:FSLR).

While the Chinese market is currently dominated by Chinese manufacturers such as Trina Solar, Yingli, and JA Solar (NASDAQ:JASO), this may change in the future as manufacturers from other countries become more cost competitive with Chinese firms. It is already a given that Chinese solar manufacturers will benefit enormously from China's increasing solar ambitions. While Chinese solar manufacturers have dominated the industry in terms of cost-effectiveness, there are many reason to believe why this will change moving forward.

As technology starts to play an increasing role in manufacturing, and larger scale is achieved by manufacturers based in other countries, many of the advantages that Chinese manufacturers currently hold should slowly fade away. While Chinese manufacturers will always hold a scale advantage due to the sheer size of China's solar market, this advantage should become comparatively smaller moving forward due to diminishing return. Regardless of how the Chinese market plays out, both China and India will drastically change the solar PV demand dynamics should everything go according to their plans. Global solar manufacturers will gain tremendously from this coming demand surge, especially those based out of China.

DOWNSTREAM EFFECT

Already, the costs associated with downstream solar is nearly equivalent to those associated with upstream solar. The trend of proportionally increasing downstream costs is accelerating, which means that downstream solar companies should gain enormously over the next decade. There may be little to no distinction between solar manufacturers and downstream companies moving forward though, as solar companies are increasingly becoming integrated across the solar value chain.

Huge downstream efforts will be required to fulfill China and India's respective goals, either in the form of large-scale solar, or small-scale distributed solar. With the industry trending towards small-scale distributed solar, downstream costs are likely going to be even higher. Soft costs take up a larger portion of total costs for smaller distributed projects, which will make the downstream segment more important than ever moving forward. With the entire solar industry integrating across the solar value chain, there will be less of a business model distinction between solar companies. SunPower (NASDAQ:SPWR), for instance, is now involved in all of the major solar segments, including small-scale residential solar.

OBSTACLES

Despite China and India's stated solar PV installation goals, these countries' abilities to attain these goals should still be met with a degree of skepticism. While China's installation target has a higher probability of being met, the same thing cannot be said about India's installation target. India essentially wants to catch up to China in total installed solar PV capacity in just under a decade's time, which may prove to be extremely difficult considering the fact that the country's current solar market is comparatively nonexistent. On top of this, India's shoddy infrastructure will make its installation goals even harder to meet. On the other hand, India has one of the friendliest solar climates in the world, largely due to its proximity to the equator.

In the case of China, there is a much higher likelihood of the country meeting its 100 GW installation goal by 2020. The question is whether international companies (based in countries outside of China) will be able to benefit from this ambitious solar target. So far, it seems as if Chinese solar companies will get the vast majority of business in the country. Leading Chinese solar manufacturers such as Trina Solar, Yingli, etc, will almost certainly enjoy disproportionate benefits from the Chinese government's ramping installation goals.

If these countries do not meet installation expectations, many solar firms will lose large sums of capital from overinvesting in manufacturing capacity. Solar standouts such as SunEdison have already invested untold billions in India in preparation for the country's planned solar PV boom. If India's solar ambitions do not come to fruition, SunEdison will have essentially wasted a huge chunk of its resources on the country. While a similar situation could occur in China, it is unlikely given the country's centralized planning and superior energy infrastructure relative to that of India's.

CONCLUSION

China and India will increasingly have a disproportionate impact on the global solar market, and as such, will contribute enormously to overall solar PV demand. The global solar industry has already felt China's large effect over the past decade, and with India joining in on the race towards solar PV domination, the global solar industry will undoubtedly experience an unprecedented amount of change over the next decade. This makes it an optimal time to invest in the solar industry, as leading solar companies are poised to profit immensely from China and India's ramping solar ambitions.

DISCLOSURE: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (MORE)The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Article source: http://seekingalpha.com/article/3055656-chinas-and-indias-increasing-impact-on-the-solar-industry

The post China's And India's Increasing Impact On The Solar Industry appeared first on Renewable Electron.

0 comments:

Post a Comment